Federal Reserve Finalizes Terms for Non-Profit Organization (NPO) Expansion of Main Street Lending Program

On July 17, 2020, the Federal Reserve (the Fed) announced that it had finalized certain modifications to the terms of the Main Street Lending Program (MSLP) to provide greater access to credit for nonprofit organizations (NPOs), such as eligible educational institutions, hospitals and social service organizations (among other eligible NPO borrowers).

The Fed had previously released draft term sheets for MSLP lending to NPOs on June 15, 2020. Those preliminary term sheets have now been updated and finalized based on public comment and further internal consideration by the Fed. The final updated NPO lending terms are meant to support a broad set of NPOs that were in sound financial condition prior to the COVID-19 pandemic.

Key changes to the NPO term sheets for the MSLP include the following:

- The minimum employment threshold for NPO borrowers was lowered from 50 employees to 10 employees

- The limit on donation-based funding was eased

- Several financial eligibility criteria were adjusted to accommodate a wider range of NPO operating models

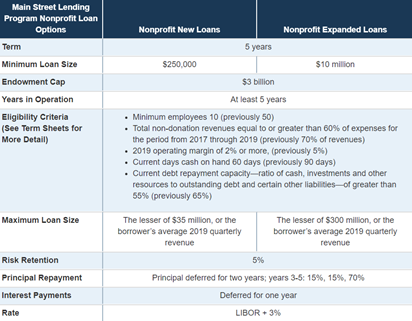

The MSLP lending terms for NPOs generally mirror those applicable to for-profit MSLP borrowers, including the interest rate, principal and interest payment deferral, five-year term and minimum and maximum loan sizes. NPOs will be eligible for two loan options, New Loans and Expanded Loans, which are summarized in the Fed’s updated table below:

As with the initial June 15 preliminary term sheets, each eligible NPO borrower must be a tax-exempt organization under Section 501(c)(3) or Section 501(c)(19) of the Internal Revenue Code.

NPOs that are interested in learning more about MSLP loans should contact Erik Daly, Loic Dimithe or Chelsea Austin to discuss the program in more detail and further assess their eligibility to participate. Each of Erik, Loic and Chelsea is working with Miller Johnson’s cross-functional COVID-19 response team to help mitigate the fallout from this crisis by working together with clients, government, community organizations and other professionals.