New HSA/HDHP Limits for 2024

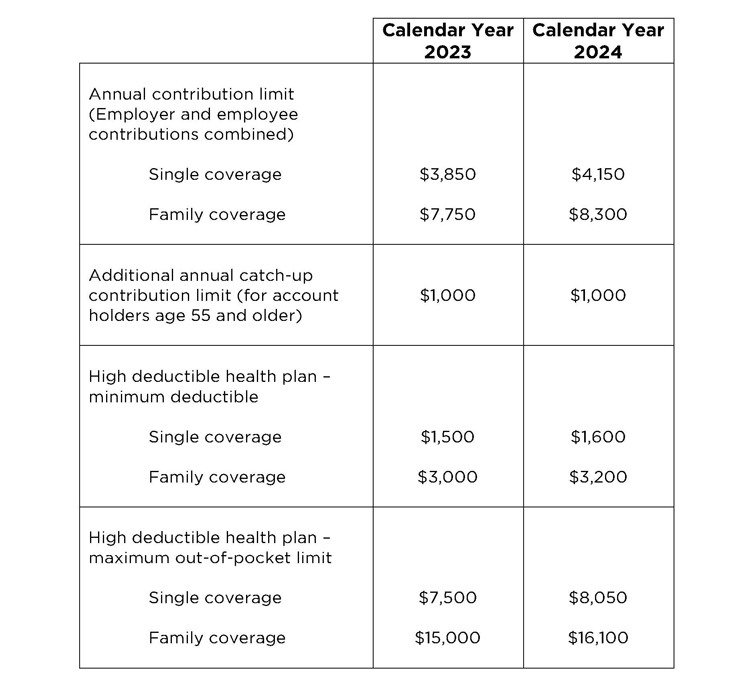

The IRS has announced the inflation-adjusted limits for health savings accounts and high deductible health plans for 2024. The annual contribution limits, HDHP minimum deductibles, and HDHP maximum out-of-pocket limits will be increasing. The additional annual catch-up contribution limit (for account holders age 55 and older) will remain the same. Below is a summary:

If you have any questions regarding HSAs, high deductible health plans, or the new limits, please contact the authors or a member of the Miller Johnson Employee Benefits and Executive Compensation Practice Group.